The advent of smartphones has revolutionized numerous industries through digital transformation. KakaoTalk has transformed the communication market, Uber has changed the transportation sector, Airbnb has transformed the lodging industry, and Market Kurly and Coupang have innovated the retail industry. Similarly, Toss, KakaoBank, Apple Pay, and Samsung Pay have innovated the financial sector. These diverse industries have been transformed by digital technology, a phenomenon known as xTech. We also look ahead to the current state of fintech, which represents the digital transformation of finance, and how AI will further revolutionize finance and create new user experiences and markets.

The Fintech Revolution of the Mobile Era

The smartphone has become an all-in-one device, functioning as a photo album, a diary, and a wallet. With a smartphone, you can make payments without cash or credit cards and perform tasks like money transfers and identity verification. The smartphone has transformed various industries to function beyond our daily lives. Among those changes, the most significant one is changes in payment. You don't need to carry a wallet if you have a smartphone. Every day we use public transportation, buy coffee, order food at restaurants, and shop, where each activity involves financial transactions. Additionally, consulting on insurance, investments, or savings is a financial service that requires phone calls or bank visits. Now, all these services can be managed through mobile apps.

Before the advent of smartphones, internet banking services existed through websites and home banking via mobile phones. However, they were less reliable and convenient than mobile services, hence used in limited situations. While it was possible to make payments on online shopping websites, check your bank balance, and transfer money, the cumbersome user authentication process required for security posed many limits on use. In other words, internet banking before the mobile era had poor usability due to the stringent authentication procedures needed for thorough security. For instance, to make online payments, users had to use a digital certificate that required installing various programs, such as firewalls, keyboard security programs, digital certificate login systems, and anti-hacking software. These programs were prone to errors and had to be reinstalled and reissued annually, making online payments, internet banking, and year-end tax settlements a digital burden due to the inconvenience they caused.

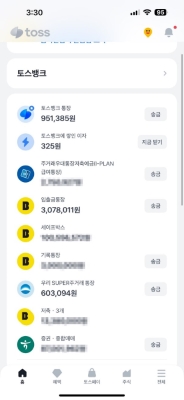

However, thanks to fintech and security authentication applications, these inconveniences have disappeared in an instant. Samsung Pay and Apple Pay allow users to make payments in stores without using physical credit cards, and various fintech apps enable users to access financial services instantly without visiting a bank. In fact, these apps provide comprehensive financial services that previously required visiting multiple banks and insurance companies. For instance, with apps like Toss, users can view their savings and checking accounts from various banks and track their credit card transactions all in one place. Also, they can receive recommendations for the best insurance products or credit cards based on their asset information. Moreover, using internet-only banking apps, such as KakaoBank, users can open accounts remotely and conveniently access traditional financial services online.

Over a decade has passed since the innovation of financial services based on technologies began in earnest. In the early 2010s, fintech services flourished thanks to smartphone’s characteristic, which, unlike PCs, offered biometric authentication and served as a personal portable device containing private information. Later, with the introduction of the three data-related laws in Korea, the MyData industry became available since August 2020. These credit information laws made it legally permissible to integrate and view various financial data across the financial sector. In fact, it wasn't until 2022 that users could check their asset status spread across different financial institutions and access financial services, such as transfers, using financial apps like Toss. Thanks to the legal facilitation of financial data access and asset connectivity, fintech services could fully blossom.

The Fintech 2.0 Era in the Age of AI

And so traditional analog finance has combined with mobile technology, evolving into fintech. Now, 10 years later, what new innovations can fintech undergo? The answer lies in ChatGPT, which made waves in 2023 and is expected to open new opportunities for Fintech 2.0. ChatGPT is set to bring three new experiences to financial services: Hyperpersonalization, Hyperintelligence, and Conversational UI.

In fact, financial information is the most private information. Everything is contained within the financial information, from the monthly income and asset size to detailed records of daily spending. The data accumulated is both quantitatively and qualitatively more valuable and complex than our search history data. The technology behind ChatGPT, known as Large Language Models (LLMs), is an AI model that excels in data analysis and reasoning based on vast amounts of language data. LLMs can analyze the ever-growing mountain of financial data to provide necessary financial services tailored to each individual. In short, it enables the provision of hyperpersonalized services. LLM summarizes and categorizes information, generating new content through various combinations. LLM-based analysis and interpretation of the personal financial data accumulated in mobile fintech apps enables optimized, personalized financial services for each individual.

Capable of finding answers within vast amounts of data, LLMs will also enable hyperintelligent financial services. LLMs can be used for complex financial analysis and prediction tasks, such as detecting fraudulent transactions, evaluating credit, assessing loan applications, managing various review documents and contracts, and forecasting market volatility. Big data analysis and machine learning technologies have already been used in the back offices of the financial industry. Just as many chatbots and data analysis tools were prevalent but AI brought a technological singularity, the advent of LLM-based financial back offices have enabled hyperintelligent services, which previously seemed impossible. In addition to personal financial data, LLMs are continuously learning publicly available social media data and personal information from smartphones approved by users, enabling more reliable and accurate financial service operation and development of new financial product.

Finally, one of the most noteworthy aspects of ChatGPT technology is not the "GPT" part of the technology but rather the "Chat" interface. The core characteristic of this technology is that it allows AI to be used as a conversational interface. While Fintech 1.0 involved interacting with financial services by tapping a smartphone screen, Fintech 2.0 will shift to a conversation-based approach. Instead of navigating menus on a screen to access the financial services you need, you can simply ask questions and receive answers in a consultative manner. The best way to comfortably use complex financial services is to talk with a professional advisor. However, such advisors are typically only available for VIP clients due to cost issues. With AI implemented through LLMs, this high-level professional financial advisory service can be accessible to everyone.

The Future Brought About by Digital Financial Innovation

So, what will Fintech, revolutionized by AI following the mobile era, look like? To understand the difference, consider how financial services used in traditional banks compare to those available on mobile platforms. Banks have been able to run safer and more convenient financial services with fewer resources, while customers have gained the ability to manage numerous accounts and cards, search for financial products, and access services 24/7 using their smartphones. Similarly, Fintech 2.0, driven by AI technology, will enable both financial institutions and customers to operate more advanced financial services.

Whenever you make payments, conduct financial transactions, or use financial services, your personal AI financial assistant will provide appropriate services tailored to the situation, regardless of device or app types. In case of any suspicious transactions, the AI will not only detect and immediately alert the credit card company and the individual but also give immediate countermeasures. Also, the AI can analyze your spending patterns, suggesting ways to reduce unnecessary expenses, or recommending suitable investments to help grow your assets. In this way, the AI financial assistant will continuously monitor the user's financial health and offer the necessary advice to help them achieve their financial goals. This will provide hyperpersonalized financial management that traditional financial services could not.

For example, the AI can recommend the best loan product or suggest an appropriate investment portfolio by analyzing a user's financial situation. This lowers the barriers to accessing financial services and enables more people to easily enjoy financial benefits. From the financial industry's perspective, AI will lead to even greater automation and efficiency in financial services. By automatically handling repetitive and time-consuming financial tasks, AI will allow financial institutions to reduce operational costs and provide better customer service. For example, in the loan approval process, AI can instantly assess an applicant's creditworthiness and automatically review the necessary documents, significantly reducing the loan approval time. This means faster service for customers and provides financial institutions with the opportunity to manage more customers efficiently. In this way, advancing AI and big data technologies will greatly enhance financial security. AI can analyze transaction data in real time to detect suspicious activities and swiftly block potential fraudulent actions. Unlike traditional reactive approaches, this enables proactive prevention. For instance, if AI detects suspicious activity in a user's account, it can immediately send a warning and take actions such as locking the account. This helps prevent financial incidents before they occur and offers enhanced protection for customers' assets.

In the future, AI-driven Fintech 2.0 will bring about fundamental changes in the financial industry. Key benefits of AI in Fintech include the provision of hyper-personalized financial services, a revolution in financial accessibility, enhanced automation and efficiency, and improved financial security. This innovation will benefit both financial institutions and customers, creating a more reliable and efficient financial environment. As AI technology continues to advance, the Fintech industry will offer even more diverse and innovative services, enriching our financial lives.

▶ This content is protected by the Copyright Act and is owned by the author or creator.

▶ Secondary processing and commercial use of the content without the author/creator's permission is prohibited.

- #DigitalFinance

- #Fintech

- #SamsungPay

- #Toss

- #KakaoBank

- #ApplePay

- #UserExperience

- #CustomerExperience

- #Hyperpersonalization

- #Hyperintelligence

- #ConversationalUI

He’s interested in and studying how technologies make changes in our daily lives and society, and how they can be used for BM innovations in companies.