Knowledge is Power A Safety Net for Your Shipments - Freight Forwarder is Liability Insurance ' Cargo Insurance'

With the rise of international trade, there exists a number of transport businesses, ranging from sea, air, truck and road transportations to freight brokerage. At the same time, stakeholders’ risks of getting involved with disputes, lawsuits, and compensation liability have been on the rise, too. International Freight Movement Operator’s Insurance1)(hereinafter referred to as Freight Forwarder’s Liability Insurance) is a financial product designed to help freight forwarders and logistics companies carry out their business reliably by covering their legal liabilities for loss or damage to cargo caused during the ordinary course of their business. As today’s freight forwarding and logistics companies continue to expand their reach and responsibilities around the world, this insurance has become one of the most important success factors for logistics companies.

Samsung SDS, too, is covered by freight forwarder’s liability insurance to prevent any future risks preemptively. In this paper, we’re going to look at the overview of freight forwarder’s liability insurance, its claim process and compare the liability insurance with cargo insurance.

1. Freight Forwarder’s Liability Insurance: Mandatory Requirement in Korea

Legal Grounds

Under Article 8 of the Goods Distribution Promotion Act and Article 11 of the Enforcement Degree of the same act, all freight forwarding business operators2) are required to be covered by freight forwarder’s liability insurance or guarantee insurance with minimum coverage of 100 million KRW. If violated, their business can be revoked.

Those subject to this mandatory requirement are sea, air, truck and rail carriers, forwarders, warehouse operators, customs brokers and multimodal transport operators.

2. Understanding of Freight Forwarder’s Liability Insurance

Typically, freight forwarder’s liability insurance is to cover liabilities of a carrier or freight forwarder against any loss or damage to its customers’ cargo in shipping, and special conditions and clauses can be added depending on the type of risks. Below is the four major special conditions and clauses usually found in freight forwarder’s liability insurance policy.

Liability for Loss or Damage to Goods in Transit

The Goods in Transit insurance policy offers protection against loss, destruction, or damage to goods while they in transit within the limit of indemnity stated in the insurance policy. It is often used as a way of defense against a claim for indemnity3) raised by the insurer of the cargo owner.

Picture 1. Damage During In Transit

Picture 1. Damage During In Transit

Picture 2. Damage During In Transit

Picture 2. Damage During In Transit

Liability for Loss or Damage to Goods in Warehouses

This liability insurance covers liability for physical loss, damage, degradation, contamination of goods stored in warehouses within the extent of coverage specified in the insurance policy. Policyholders of this insurance are usually warehouse operators(lessees).

Picture 3. Damaged Goods While In Warehouse

Picture 3. Damaged Goods While In Warehouse

Errors & Omissions

This is to offer protection in this errors and omissions insurance policy protects the insured person from a claim by the consignor, consignee or a customs authority for the loss caused by its negligence, errors or omissions. The insured person is covered within the extent of coverage specified in the insurance policy.

e following cases:

- The insured, its employees or subcontractors’ errors or omissions

- The insured, its employees or subcontractors’ inadequate work

- The insured, its employees or subcontractors’ failure to provide accurate advice or information

If goods are delivered to a wrong destination, the insurer compensates for the additional costs expected to send the goods to the right destination. Here, ”the costs expected” is calculated by adding the actual transport cost between the points of origin and wrong destination to the transport cost between the points of wrong and right destination and subtracting rates between the points of origin and right destination and other expenses. Unless it is not air transport from the first place, air transport cost is not indemnified.

Liability To a Third Party

This insurance covers liability for the damages below arising as a result of negligent acts of the insured in the course of ordinary service within the indemnity limit specified in the insurance policy.

》Physical loss of or damage to property of a third party during the period of insurance

》Death of or bodily injury to a third party during the period of insurance

Note that “a third party” does not include any property owned or leased by the insured, the insured’s employees, agents or subcontractors.

So far, we have looked at major special clauses and conditions in freight forwarder’s liability insurance policy. There can also be other special clauses an insurance company suggests for additional loss expected. Examples of this may include legal expenses incurred that the insured person is liable to pay as a result of any claim made against the person and that is recoverable under the policy. Another example is costs incurred for clean up of cargo debris consequent to an unexpected and unforeseeable accident.

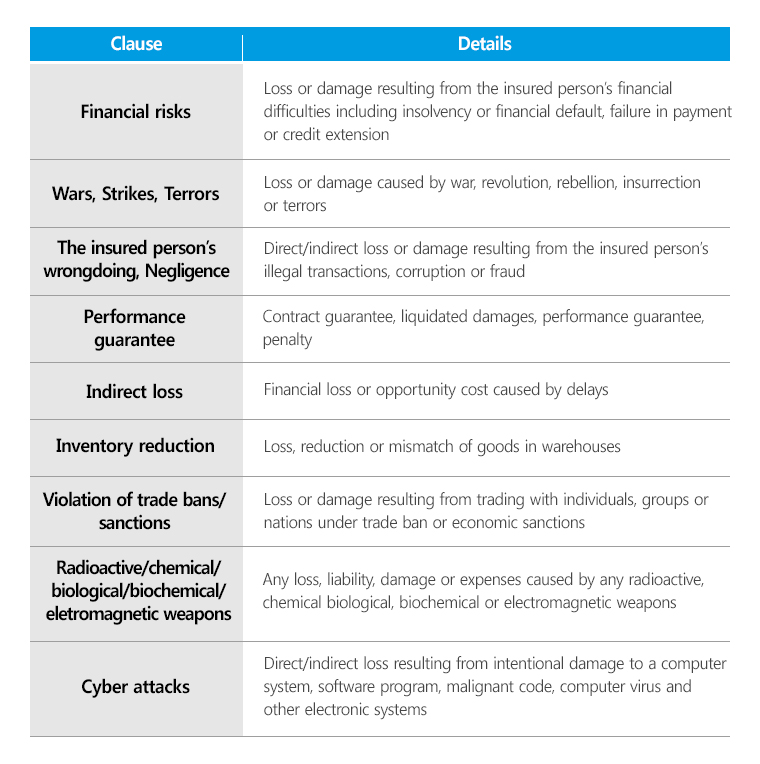

Exclusions

The insured of the insurance with the special clauses explained earlier are covered for various risks as specified in the insurance policy. However, because freight forwarder’s liability insurance only covers legally-proven liabilities of the insured person, there are some exclusions in the policy to indicate losses that will not be indemnified under the insurance agreement. Below is the list of exclusion clauses in freight liability insurance policy.

Table 1. Exclusion Clauses

Table 1. Exclusion Clauses

4. Claims

For more details, you can download a White Paper from Samsung SDS Insight Report.

▶ The contents are protected by copyrights laws and the copyrights are owned by the creator and Samsung SDS.

▶ Re-use or reproduction as well as commercial use of the contents without prior consent is strictly prohibited.

- Part1 Blockchain, a Game Changer for Logistics!

- Part2 Achieving Greater Visibility 'Smart Containers'

- Part3 Powered by AI, Cello Forecasts the Future

- Part4 Knowledge is Power! A Safety Net for Your Shipments - Freight Forwarder’s Liability Insurance, Cargo Insurance

- Part 5 Understanding of Logistics Network Optimization - Why and How to Optimize a Logistics Network?

- #Cello

- #Freight Forwarder’s Liability Insurance

- #Cargo Insurance

- #Claim Process

- #Liability for Loss or Damage

- #Samsung SDS

Junghyuk Woo is currently responsible for the Contract Logistics as Principal Consultants for Contract Logistics Group of SL Business Unit at Samsung SDS.

Key projects : Managing freight forwarder’s liability insurance for each region,Response to insurance claims in regions/branches

- Amazon Earns from Logistics

- Leading the Innovative Smart Logistics - Smart Logistics Media Day & Cello Conference 2018

- Understanding of Logistics Network Optimization - Why and How to Optimize a Logistics Network?

- Powered by AI - Cello Forecasts the Future

- Achieving Greater Visibility 'Smart Containers'