The Sustainability Report 2024 has been published this year amidst the unrelenting interest in ESG*. To realize our ESG vision, we are continuously promoting ESG activities, and as part of these efforts, we publish the Sustainability Report every year.

* ESG : Environment, Social, Governance

We would like to share with you the highlights of our Sustainability Report 2024, which is filled with our ESG core performance, ESG vision, and business strategies for the past year.

This Sustainability Report is composed of two main sections, ESG Management, which contains our ESG vision and management strategy, and ESG Performance, which summarizes our qualitative and quantitative performance in each ESG area. In ESG Management, we disclosed 11 strategic tasks in all areas of ESG that were established based on our ESG vision.

In the environmental area, we selected "Leverage technology to curb carbon emissions," "Provide eco-friendly products and services," and " Build ESG value delivery system." In the social area, we selected " Reinforce DEI*," "Expand safety and health management," " Strengthen ESG management in the supply chain," and " Establish a digital responsibility system.” Finally, in the area of governance, we have selected "Enhance BOD independence," "Prepare shareholder protection mechanisms," "Upgrade business ethics and compliance management," and "Strengthen information security risk management" as strategic tasks.

* DEI : Diversity, Equity, Inclusion

Roadmap for implementing strategic initiatives

Roadmap for implementing strategic initiatives

Sustainability Management Strategy

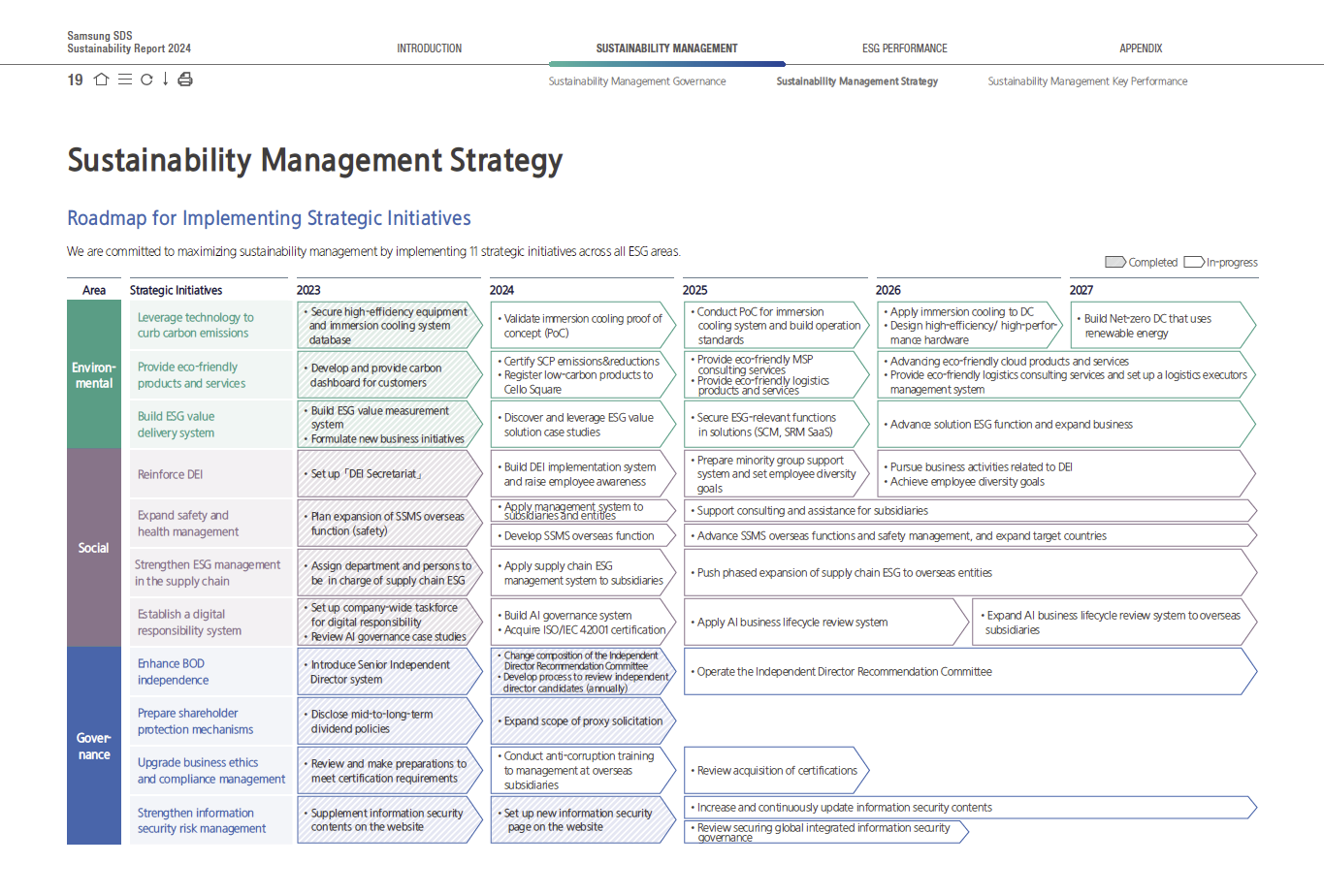

Roadmap for Implementing Strategic Initiatives

We are committed to maximizing sustainability management by implementing 11 strategic initiatives across all ESG areas

| Area | Strategic Initiatives | 2023 | 2024 | 2025 | 2026 | 2027 |

| Environmental | Leverage technology to curb carbon emissions | Secure high-effidency equipment and immersion cooling system database | Validate immersion cooling proof of concept (POC) | Conduct POC for Immersion cooling system and build operation standards | Apply Immersion cooling to DC Design high-efficiency/Nighrperfor mande hardware | Build Net-zero DC that uses enewable energy |

| Provide eco-friendly products and services | Develop and provide carbon dashboard for customers | •Certify SCP emissions&reductions •Register low-carbon products to Cello Square | Provide eco-friendly MSP consulting service Provide eco-friendly logistics products and services | Advancing eco-friendly cloud produds and services Provide eco-friendly logistics consulting services and set up a logistics executors management system | ||

| Bulid ESG value delivery system | Build ESG value measurement System Formulate new business initiatives |

Discover and leverage ESG value solution case studies | Secure ESG-relevant functions in solutions (CSCM, SRM SaaS) | Advance solution ESG function and expand business | ||

| Reinforce DEI | Setup DEl Secretariat | Build DEI implementation system and raise employee awareness | Prepare minority group support system and set employee diversity goals | Pursue business activities related to DEI. Achieve employee diversity goals | ||

| Expand safety and health management | Plan expansion of SSMS overseas function(safety) | Apply management system to subsidiaries and entities | Support onsulting and assistance for subsidiaries | |||

| Develop SSMS overseas function | Advance SSMS overseas functions and safety management, and expand target countries | |||||

| Strengthen ESG management in the supply chain | Assign department and persons to be in charge of supply chain ESG | Apply supply chain ESG management system to subsidiaries | Push phased expansion of supply chain ESG to oeverseas entities | |||

| Establish a digital responsibility system | Set up company-wide taskforce for digital responsibility Review AI governance case studies |

Build AI governance system Acquire ISO/IEC 42001 certification |

Apply AI business lifecycle review system | Expand AI business lifecycle review system to overseas subsidiaries | ||

| Governance | Enhance BOD independence | Introduce Senior Independent Director system | Change composition of the indipendent Director Reommendation Committee Develop process to review independent director candidates(annally) |

Operate the independant Director Recommendation Committee | ||

| Prepare shareholder protection mechanisms | Disclose mid-to-long-term dividend policies | Expand scope of proxy solicitation | ||||

| Upgrade business ethics and compliance management | Review and make preparations to meet certification requirements | Conduct anti-corruption training to management at overseas subsidiaries | Review acquisition of certifications | |||

| Strengthen information security risk management | Supplement information security contents on the website | Set up new information security page on the website | Increase and continuously update information secunty contents | |||

| Review securing global integrated information security governance | ||||||

In ESG Performance, we present our key ESG achievements over the past year. In the Environment section, you can find information on our environmental management strategy and climate change response. In particular, this year's report provides more detailed information on water resources and waste management. In the Social section, we cover employee human rights and development, work-life balance, health and safety, customer growth, ESG for suppliers, and community contributions, as well as new disclosures on our DEI policy, digital stewardship, and AI governance. Finally, the Governance section covers our performance on shareholder-friendly management, risk management process, ethics and compliance management system, and information security system.

Sustainability management key performance Key Figures

Sustainability management key performance Key Figures

Sustainability management key performance

Key Figures

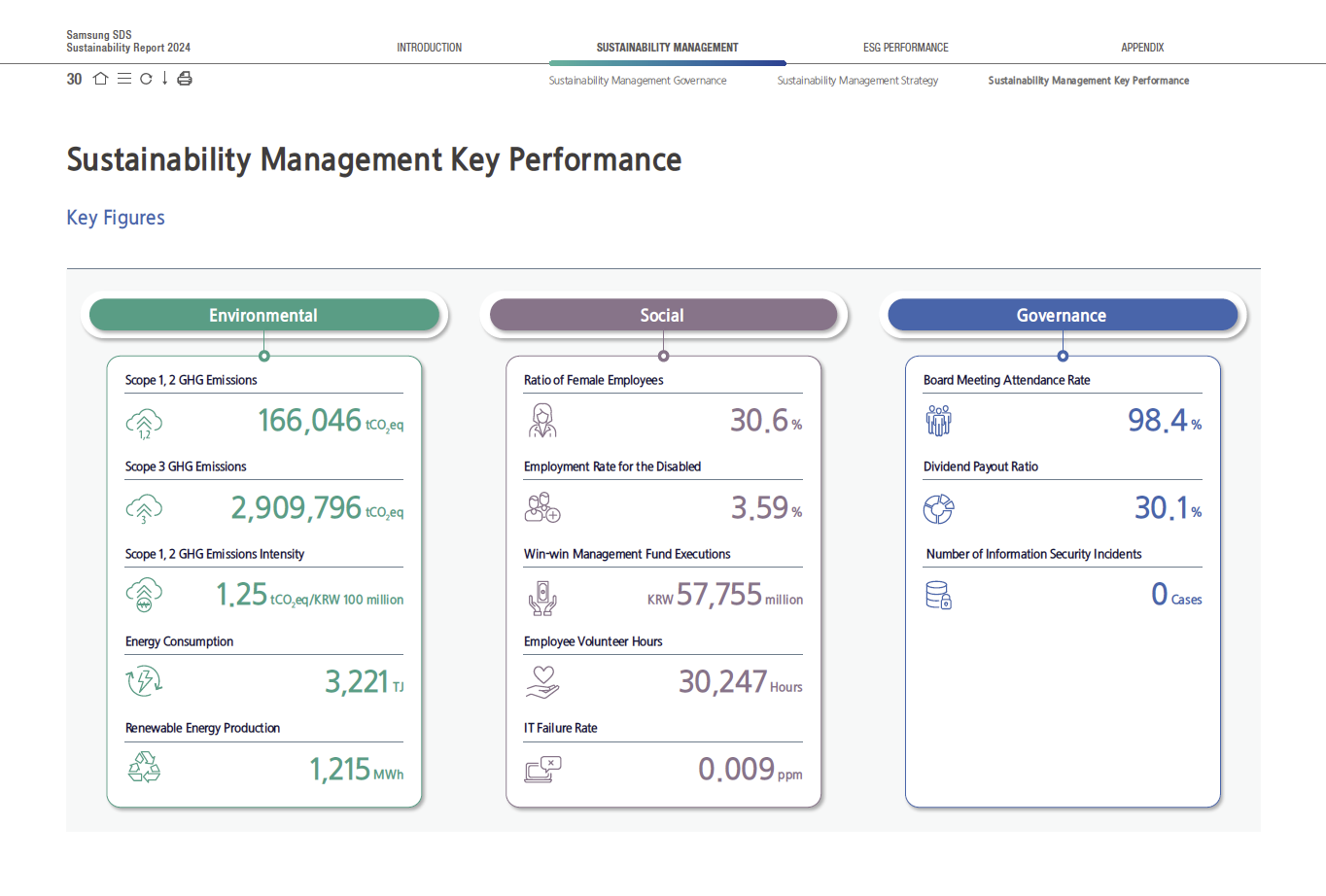

Environmental

Scope 1, 2 GHG Emissions 166,046 tCO2eq

Scope 3 GHG Emissions 2,909,796 tCO2eq

Scope 1, 2 GHG Emissions Intensity 1,25 tCO,eq/KRW 100 million

Energy Consumption3,221 TJ

Renewable Energy Production 1,215 MWh

Social

Ratio of Female Employees 30.6%

Employment Rate for the Disabled3.59%

Win-win Management Fund Executions KRW 57,755 milion

Employee Volunteer Hours 30,247 Hours

IT Failure Rate0.009 ppm

Governance

Board Meeting Attendance Rate 98.4%

Dividend Payout Ratio 30.1%

Number of Information Security Incidents O Cases

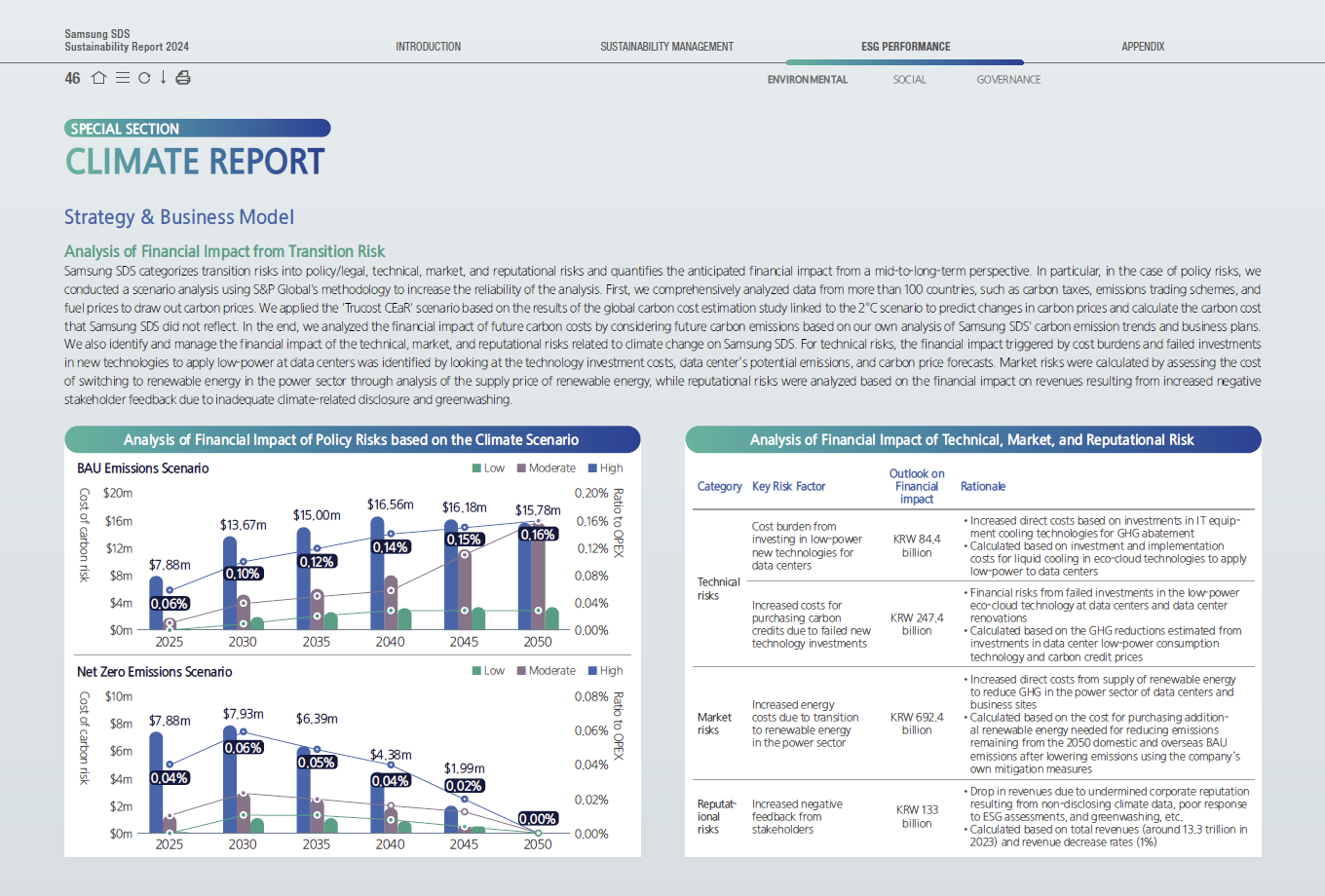

We also released a special section of the report, the Climate Report. We analyzed our responsibilities and roles in climate-related risks and opportunities, as well as financial and physical risks and business opportunities. To evaluate climate-related opportunities and incorporate them into our business strategy, we plan to redefine low-carbon solutions that can contribute to greenhouse gas mitigation and adaptation, and through these services, create new business opportunities while responding to climate change.

Climate Report

Climate Report

CLIMATE REPORT

Strategy & Business Model

전Analysis of Financial Impact from Transition Risk

Analysis of Financial Impact of Policy Risks based on the Climate Scenario

BAU Emissions Scenario (Cost of carbon risk $m, Ratio to OPEX %)

- 2025: High: $7.88m, Moderate: 0.06%, Low: $0m

- 2030: High: $13.67m, Moderate: 0.10%, Low: $2m

- 2035: High: $15.00m, Moderate: 0.12%, Low: $3m

- 2040: High: $16.56m, Moderate: 0.14%, Low: $4m

- 2045: High: $16.18m, Moderate: 0.15%, Low: $4m

- 2050: High: $15.78m, Moderate: 0.16%, Low: $4m

Net Zero Emissions Scenario (Cost of carbon risk $m, Ratio to OPEX %)

- 2025: High: $7.88m, Moderate: 0.04%, Low: $0m

- 2030: High: $7.93m, Moderate: 0.06%, Low: $2m

- 2035: High: $6.39m, Moderate: 0.05%, Low: $2m

- 2040: High: $4.38m, Moderate: 0.04%, Low: $1.5m

- 2045: High: $1.99m, Moderate: 0.02%, Low: $1m

- 2050: High: $0m, Moderate: 0%, Low: $0m

Analysis of Financial Impact of Technical, Market, and Reputational Risk

| Category | Key Risk Factor | Outlook on Financial Impact | Rationale |

| Technical risks | Cost burden from investing in low power new technologies for data centers | KRW 84.4 billion |

|

| Increased costs for purchasing carbon credits due to failed new technology investments | KRW 247.4 bihon |

|

|

| Market risks | Increased energy costs due to transition to renewable energy in the power sector | KRW 6924 billion |

|

| Reputat lonal risks | Increased negative feedback from stakeholders | KHW 133 bition |

|

With our ESG vision of "IT's the Key to Sustainable Growth", we are constantly pursuing change and innovation, and adding ESG value to our products to fulfill our social responsibility. We hope that this Sustainability Report will give you a glimpse into our future vision and strategies, and provide you with an opportunity to prepare for the future together.

The report is published on samsungsds.com, so if you're interested in learning more about our ESG management, check it out now!