The impact of digital payments according to changes in the digital environment

The process of purchasing products on the Internet through a computer or mobile phone without visiting stores is no longer an unusual occurrence in our lives. The development of online payment systems, such as fintech, and delivery and logistics structures, is accelerating the growth of the e-commerce market along with the impact of COVID-19. The global e-commerce market has been growing at an average annual rate of more than 20% over the past decade, and this growing trend is expected to continue.

Consumer needs for online product purchases are also rapidly changing. According to the 2021 Payment and Settlement Report published by the Bank of Korea, convenience (45.8%) and acceptability (26.2%) accounted for 72% of the total as the main factors that consumers consider when purchasing products and paying online. This shows that when purchasing online, not only cost discounts through payment methods but also how conveniently the preferred payment method can be used have become more important. In particular, support for various online payment services (digital payment, wallet, etc.) that are more convenient, safer, and offer many benefits linked to credit and debit cards along with simplified purchase procedures has become an important topic.

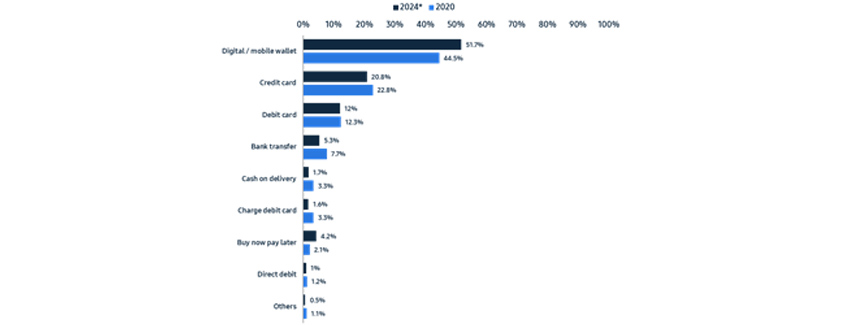

- digital/mibile wallet - 2024:51.7%, 2020:44.5%

- credit card - 2024:20.8%, 2020:22.8%

- debit card - 2024:12%, 2020:12.3%

- bank transfer - 2024:5.3%, 2020:7.7%

- cash on delivery - 2024:1.3%, 2020:3.3%

- charge debir card - 2024:1.6%, 2020:3.3%

- buy new pay later - 2024:4.2%, 2020:2.1%

- direct debit - 2024:1%, 2020:1.2%

- others - 2024:0.5%, 2020:1.1%

As the convenience and acceptability of payment methods become more important to consumers concerning online product purchases and payments, it has become very important for companies to produce actual purchases through marketing or promotional activities that attract customers' interest in online marketing channels (web, apps, SNS, etc.) and provide convenient and diverse payment services. Accordingly, companies are making great efforts to simplify the purchase process and increase the conversion rate of customers visiting the online sales channels through linking services and strengthening payment platforms, such as digital wallets (Samsung Pay, etc.) or online payment services (PayPal, etc.), as well as providing discounts linked to existing banks and card companies in their own sales channels.

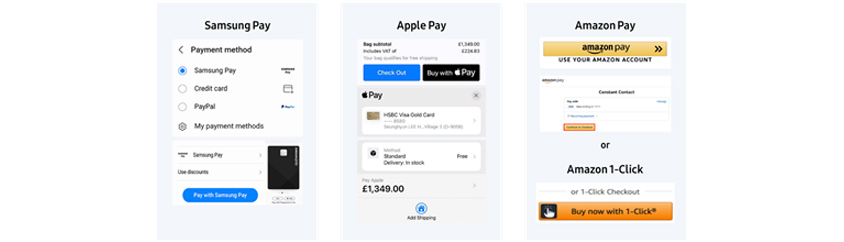

Samsung Electronics and Apple are putting a lot of effort into enhancing their payment services using mobile-based digital wallets. When purchasing a product on mobile, simple payments are possible with one click, and there is no need to re-enter additional information (name, address, card information, etc.) related to the purchase as it is linked to the existing information registered and stored in the account. In addition, Samsung Electronics supports consumer payments in connection with various payment services (PayPal, Amazon Pay, and Google Pay) on its online purchase website, and Apple supports services in connection with PayPal. Amazon provides a "1-click" payment service on its official website to increase the actual purchase rate of consumers and emphasizes the convenience of consumers' payments through non-stop payments in connection with the previously registered account information (card, name, delivery address, etc).

[Figure 2] Online Payment System – (left) Samsung Electronics mobile payment, (middle) Apple mobile payment, (right) Amazon web payment

[Figure 2] Online Payment System – (left) Samsung Electronics mobile payment, (middle) Apple mobile payment, (right) Amazon web payment

In addition to simplifying the purchase process, the digital payment market is developing with more convenient support for consumers' purchases by providing various payment options and linking them with financial services. A typical example is the Buy Now Pay Later (BNPL) deferred payment service. It is a structure that supports deferred payment services in collaboration with global financing companies (Affirm, PayPal, Klana, etc.). It has been spotlighted among the MZ generation, who have irregular income and difficulty getting approved for credit cards, but it is now becoming common across all age groups, mainly in the US and Europe (UK, Germany, France, Italy, etc.), instead of personal financing due to its low interest rate. Consumers can choose the product they want to purchase and easily purchase it by setting the desired payment plan (number of payments, period, etc.) at a low interest rate of 0-1%, regardless of the credit rating information. However, interest rates may rise and late fees may be charged depending on the company's operating policy and whether consumers' payments are overdue. As discussed above, companies will support various online payment service options in a convenient structure in online sales channels, and efforts to encourage consumers to make actual purchases will continue according to changes in consumer online purchase and payment needs (high convenience and acceptability).

▶ The content is protected by the copyright law and the copyright belongs to the author.

▶ The content is prohibited to copy or quote without the author's permission.

Marketing Strategy Team, Consulting Business Unit, S-Core Co., Ltd.

Based on global management consulting experience, he is carrying out projects to establish business strategies in various industries, such as manufacturing and service, as well as marketing strategies in the digital environment.